What You’ll Uncover in Ron Legrand How to get rich in your IRA and never pay taxes

Ron Legrand – How to get rich in your IRA and never pay taxes

Lastly, the key of the extremely rich is revealed to the little man, and, for as soon as, the much less cash you’ve to begin with, the higher it really works! learn my following message your monetary state of affairs…

Pricey Good friend,

Do you know there is a secret IRS regulation you need to use to get rich with out pay taxes on your newly discovered wealth? Do not feel unnoticed of the loop should you did not as a result of this secret is one most CPAs aren’t even privileged to.

Not solely does this “secret regulation” really exist, however you can too use it to go your tax-free riches on to your youngsters and grandchildren. No, this is not some defiant, tax-protest fantasy or Caribbean offshore scheme designed to cheat the IRS, neither is it some imprecise loophole the IRS hasn’t but closed.

All of these issues will ultimately get you in hassle or ultimately land you in jail. What I am about to reveal to you is completely authorized, in truth, inspired by the US authorities itself.

My identify is Ron LeGrand, and as chances are you’ll or could not know, I have been in the enterprise of instructing folks how to get rich in actual property for over 27 years. I’ve purchased and offered over 1,600 properties for income which have made me a millionaire.

I am also called the “Millionaire Maker” as a result of I not solely do I do what I educate, not like a lot of the different so-known as “real estate gurus”, I assist my college students expertise related success utilizing my secrets and techniques and Programs.

Utilizing my distinctive strategies and methods, lots of of my college students have risen from humble beginnings, as I did a few years in the past, to create wealth out of skinny air and revenue wildly utilizing none of their very own cash, solely what I educate them.

There may be, nevertheless, an issue if you turn into this profitable. Once you begin getting cash, particularly in actual property, Uncle Sam comes calling, and you’ve to consistently write him massive, fats tax checks, a painful expertise at greatest. I do know as a result of I’ve personally written him some massive ones through the years. Heck, I’ve most likely funded the complete US Congressional payroll.

Whereas I’m a regulation-abiding citizen and grudgingly pay my taxes on time every year, I’m solely in paying what’s legally owed and not a cent extra. I’m a agency believer in President Eisenhower’s philosophy that it’s the obligation of each American to pay no extra in taxes than what she or he owes legally.

In my quest to stay up to my patriotic obligation, I talked to each tax skilled beneath the solar, however irrespective of which skilled I talked to, I all the time felt like I used to be overpaying. So I set out on a mission…a mission to uncover how I may legally pay absolutely the naked minimal in taxes or perhaps even no taxes.

I continued to scour the nation to discover one of the best minds accessible to present me how I may legally pay no taxes, and, fairly frankly, I didn’t assume it may very well be accomplished till I discovered one man with the reply I used to be looking and hoping for. “You really can legally make a fortune and pay no taxes on it. Furthermore, the government actually wants you to do this!”

Again in 1997, Congress, in a uncommon stroke of genius, handed what they known as the “Taxpayer Relief Act.” Hidden in that act was a provision by the then Senate Finance Committee Chairman William Roth that created a brand new sort of IRA (Particular person Retirement Account) designed to encourage extra financial savings amongst People.

Not like a conventional IRA the place you get a tax deduction on the cash you contribute and pay taxes when that cash comes out, the Roth IRA works simply the other.

You don’t get a tax deduction on any contribution you make up to $5,500.00 a 12 months relying on your present earnings; however you additionally don’t have to pay taxes if you take cash out, and it grows tax free inside your IRA.

Right here’s the kicker, although, and I would like you to pay shut consideration. I’m about to reveal the HUGE SECRET only a few accountants or legal professionals have a clue about, and those that do have a vested curiosity in conserving this secret from you…

The Tax-Free wealth secret Attorneys, Stockbrokers and Bankers DON’T need You to Know (However the IRS Does!)

Right here it’s: Your Roth IRA could be “self directed.” I understand that in the first place look, that secret could not sound like an enormous deal to most individuals, however to the good actual property investor, i.e. the one who follows what I educate, it’s a massive deal, a HUGE DEAL. One that may effortlessly make you rich!

Right here’s why: The best way the regulation is written, you possibly can solely contribute up to $5,500 a 12 months, BUT you can also make as a lot cash inside your IRA as quick as you need by controlling HOW you make investments the cash.

For those who nonetheless aren’t leaping out of your seat with pleasure like you ought to be, let me provide you with an instance the “Average Joe” has no clue about. Most individuals pay attention to their accountant or monetary advisor, as they assume they need to, and put the cash they contribute in their IRA into shares or mutual funds that develop at wimpy charges of return, or in current years in no way.

Get instantly obtain Ron Legrand – How to get rich in your IRA and never pay taxes

Even should you’re placing away the utmost contribution yearly, it takes a protracted, very long time for it to develop into something substantial, regardless that it grows tax free if you’re investing in shares, bonds and mutual funds. Pathetic and irritating, huh?

Flip $100

Into $35,000 With One Deal

Who needs to wait round to get rich? Not me and hopefully not you; nevertheless, take into account the outcomes when your Self-Directed Roth IRA does an actual property deal, following the IRS rules to the tee:

it makes a tiny funding in a home, I like to recommend $100, you then flip proper round and promote that home, turning an enormous revenue (the common revenue my college students make in the “pretty house business” is $35,000.00 by the best way).

Because it’s an funding by your IRA, not a private contribution, that cash goes proper again into your IRA, TAX FREE, FOREVER.

Take into consideration that for a second…. what number of actual property offers like that do you’ve to do to completely flood your IRA with sufficient tax-free money for your self and your household? How many instances do you’ve to make investments $100 to make $35,000.00 to pay your youngsters’s and grandchildren’s school tuition? Not many!

In our instance, the Common Joe following the recommendation of his monetary advisor invests $100 and, if he’s fortunate, will get again $112 in a 12 months, and that’s at a very good 12% return charge that’s unparalleled throughout this recession and much less commissions, after all.

The savvy actual property investor takes that very same $100, invests it in a home that doesn’t even require his personal cash to purchase if he does it my method, and will get again $35,000 in solely a month or two. Now, THAT’S what I name a return charge!

Now that you understand one in every of my many secrets and techniques, take into consideration what you are able to do when you’ve actual cash in your IRA. Impulsively you can also make $100 investments in homes whereas the money in your IRA concurrently grows tax free in different investments at 15%, 25%, and even 30% per 12 months, passively with no further work on your half.

That, My Mates, is How You Get Filthy Rich

in the US of America, Right now!

Would you want to know the step-by-step course of to do this? Would you want to know precisely how to stuff your IRA filled with tax-free money on a relentless and constant foundation? Would you want to sit again and watch $100,000, $500,000, and even $1 million develop tax free daily, hour by hour earlier than your very eyes?

Nicely, you are able to do all these items when you understand the secrets and techniques of the Self-Directed Roth IRA, secrets and techniques virtually no monetary skilled is aware of or needs you to know.

Why does your “trusted” monetary advisor need to maintain this secret from you? The reply is easy. If your IRA is self directed like I recommend, they’ll’t make any commissions primarily based on trades they make for you.

Using the secrets and techniques I do know, you get to maintain YOUR cash, cash they had been filching from every of your transactions. Your IRA will really be working for you, not for them. No surprise they need to maintain this secret from you!

Now, don’t get me improper. I don’t need to suggest all accountants, legal professionals and monetary advisors are evil people who find themselves simply out to get their fingers on your cash.

There are various monetary professionals who do have your greatest pursuits at coronary heart, but they nonetheless encourage you to make low-yield, conventional investments in your IRA as a result of they merely don’t know any higher. These Roth IRA secrets and techniques aren’t taught in any accounting program or at any regulation college or monetary establishment.

Attorneys, Accountants and Monetary Advisors Have No Clue About This Superb, Tax-Free wealth Secret.

BUT I DO

That’s why even CPAs, attorneys and monetary advisors maintain the cash in their very own IRAs in shares, bonds, and mutual funds. It’s the best way they had been taught by those that got here earlier than them, and they merely don’t know any higher.

Plus, only a few of them are actual property buyers, and if they’re, they’re the normal, “buy and hold” crowd, not “transaction engineers” like myself and my profitable college students.

Once you speak to one in every of these professionals about how to make cash shopping for and promoting homes my method, you would possibly as effectively be talking a overseas language to them as a result of THEY JUST DON’T GET IT. Actually, it scares them.

Even if you strive to patiently clarify how your Roth IRA should purchase actual property with little or no cash, their eyes glaze over, they refuse to pay attention, and they proceed to maintain tightly onto the stale strategies they discover comfortably acquainted. It’s up to now exterior their regular actuality, they actively resist what you inform them and do their greatest to counsel you towards it.

Do not Let Their Concern Of Change Hold You From Hundreds of thousands!

Plus, even should you get them organized to look into it, their monetary establishments gained’t allow them to arrange a real Self-Directed Roth IRA. At greatest, what they declare is “self directed” is admittedly a number of alternative the place you get to select from three underperforming mutual funds and a pool of low curiosity, however “safe!”, bonds. They most definitely will NOT allow you to make investments in actual property. You might have to discover a monetary establishment that specializes in self-directed IRAs, and not one in ten thousand monetary professionals is aware of the place to discover one, BUT I DO…

Fairly frankly, I solely came upon about investing in actual property inside a Self-Directed Roth IRA a number of years in the past myself, and I’ve never taught it earlier than as a result of I wished to try it out totally and make certain what my consultants instructed me was actually true and may work for my college students. IT IS, AND IT WILL!

So as to share this chance, I made a decision to staff up with the world’s foremost skilled on Self-Directed Roth IRAs, the person who discovered this “secret IRS regulation” for me, and reveal these IRA Wealth Secrets and techniques to a number of choose folks through a as soon as-in-a-lifetime seminar.

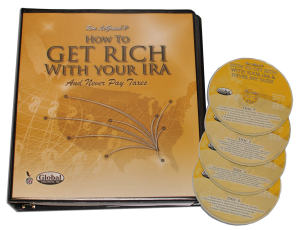

Sadly for you, I’ve already placed on this riveting seminar, and you missed out. Nevertheless, there’s excellent news… I recorded the complete seminar, and now, for the primary time, my new “How to Get Rich With Your IRA and Never Pay Taxes” seminar is out there on CD.

Earlier than I get into the thrilling particulars about my “How to Get Rich With Your IRA and Never Pay Taxes” seminar and the superb product created from it, I would like to inform you only a bit about my good pal, “Mr. X.” He really is the world’s foremost skilled on Self-Directed Roth IRAs. Mr. X has been concerned in the securities trade for greater than 35 years, and he’s at present Chairman of the Board for a monetary establishment that specializes in self-directed IRAs which is the custodian for over 20,000 Self-Directed IRA accounts, a lot of that are valued in the multi-tens of millions.

My very own Self-Directed Roth IRA is with Mr. X, as is my daughter’s and a lot of my college students. Mr. X, who’s been written about in Cash journal, understands my sort of actual property investing, and in truth, is an actual property investor himself. Like I stated, he’s the man who first let me in on the truth that I may purchase and promote actual property at large income inside my Roth IRA utilizing little or no cash. That’s why I requested him to communicate at this seminar with me.

Listed here are the little-identified, tax-free wealth secrets and techniques Mr. X and I reveal on this superb 5-CD System:

CD #1 – Why You MUST Have At Least One Roth IRA

The identify of somewhat identified firm who will arrange your Self-Directed IRA for you following the precise IRS rules, so that you’ll ensure to keep out of hassle (one thing no lawyer or CPA can assure you). This firm never recommends an funding, and, due to this fact, doesn’t get a fee steering you into non- or low-producing offers.

The weird story of how I fused the Self-Directed Roth IRA with actual property investing, creating the last word tax-free wealth machine.

Why your CPA and lawyer don’t know the secrets and techniques of the Self-Directed Roth IRA, and, in the event that they do, why they don’t need you to know them.

Why you’ll be ecstatic should you get an enormous invoice from your Self-Directed IRA administrator (the key firm I’ll set you up with).

Why you could plan for taxes BEFORE you get rich, and why you’ll hate your self should you don’t (please, be taught from my very own coronary heart-wrenching expertise).

How you actually open a tax-free IRA inside 24 hours, and the surprising purpose why you MUST accomplish that NOW.

The little identified purpose why a Roth IRA is much superior to some other kind of retirement plan.

How a lot cash will you lose by investing your cash exterior of a Roth IRA?

How your Roth IRA won’t solely develop for you tax free, however can even proceed to develop for your youngsters and grandchildren and make them millionaires too!

How to keep away from the dangerous recommendation that sounds good when it comes to a conventional IRA. Most individuals make this error that prices them tens of millions of {dollars} with out even figuring out it.

The stunning solutions to, “Will the government abolish the Roth IRA?”

When to convert a conventional IRA to a Roth IRA, and when not to. Do that improper and you instantly owe the federal government an enormous tax test; do it proper, and revenue massive time.

How to switch a Roth IRA from a conventional dealer who will NOT allow you to make self-directed investments to a “no hassle” one who will and is accepted by me, Ron LeGrand.

Why a conventional dealer or financial institution won’t allow you to make investments the funds in your Self-Directed IRA the best way YOU need to make investments them, and how to get round it.

How to have absolute, iron management over all of the investments your IRA makes, and never have to helplessly watching your portfolio shrink because the inventory market tanks once more.

Just lately divorced? Right here’s one thing you’d higher do with any current IRA, and do it FAST earlier than your ex income from your exhausting work.

The weird purpose why it is best to have “His and Hers” IRAs (if you need a cheerful marriage, that’s).

CD #2 – How To Set Up A Roth IRA Shortly And Simply So You Can Get Rich Tax FREE

How to get rich with out contributing any cash to your IRA past your preliminary $200 requirement to open one. THIS is the unbelievable, but completely authorized, secret no monetary advisor on earth is aware of about and would name you a liar should you instructed them about.

Do you have to even hassle to contribute to you IRA should you don’t want to? I’ll clarify the one good purpose it is best to, and why you might not be ready to until you act quick.

How paying your social safety tax could make you a tax-free millionaire, and it has nothing to do with social safety.

Do you make greater than $160,000 a 12 months as a pair, or $110,000 as a single? If that’s the case, too dangerous since you CAN’T qualify for a Roth IRA UNLESS you understand two secrets and techniques, that’s! You’ll find out how anybody, no matter their earnings, can have a Roth IRA.

Wait! There’s a 3rd secret as effectively, and this one can get you an enormous, fats tax deduction.

The unusual purpose why incomes one half of 1 % charge of return on your cash inside an IRA could make you rich, quick.

Asset safety secrets and techniques of an IRA. Why most predators can’t contact it even when they get a judgment towards you, and the one two predators that may.

Ought to you’ve a couple of Roth IRA? The reply is “maybe,” and whereas it has nothing to do with getting cash, it may prevent a boatload of it.

The weird purpose why you shouldn’t take cash out of your Roth IRA if you retire.

The superb “wealth pass along secret” of the Dynasty IRA.

Why you NEVER need to do a “nothing down” deal inside your Roth IRA, however don’t fear, you possibly can nonetheless generate windfall funding income utilizing a tiny sum of money so long as you understand this secret.

Why it is best to never pay IRA administrative charges from inside your IRA, and how to get a deduction on your common taxes by paying them exterior your IRA.

What to do with your tax advisor if she or he has no clue about Self-Directed Roth IRAs.

How to arrange a Roth IRA for a new child child, and make them a millionaire by the point they get to highschool with no funding from you.

CD #3 – How To Make Enormous Tax-Free Earnings By Legally In Actual Property Inside Your IRA

Step-by-step strategies to getting cash into your IRA utilizing actual property choices and lease choices.

How to choice “paper”, mortgages and belief deeds, inside your IRA to make large funding income with minimal work.

How your IRA can personal a enterprise, and why it ought to!

How to keep away from “self dealing.” Self dealing is an enormous no-no with your IRA, and if the IRS thinks you’re doing it, you’ll have to write them an enormous test, quick, up to the complete quantity in your IRA. You’d higher be taught this rule early in the sport.

How your IRA can get you each money to spend now, and money to develop tax free.

How your IRA can accomplice with your partner’s IRA on an actual property deal.

Do you’ve an aged guardian or relative you’d like to assist out? Right here’s how to use a Roth IRA to assist them stay the approach to life they honestly need, as an alternative of simply getting by on a depressing fastened earnings. These secrets and techniques would make Social Safety out of date if extra folks knew it.

How to use a Coverdell Instructional IRA account to pay for your child’s school tuition irrespective of how costly it’s, and accumulate a pleasant tax deduction on the identical time. When you’ve got a toddler you’d like to put by college from start to age 30 and never write a test for his or her tuition, journey, books, computer systems or lodging, you could have this CD!

Get instantly obtain Ron Legrand – How to get rich in your IRA and never pay taxes

When to fireplace your accountant or lawyer.

CD #4 – How To Keep Out Of Hassle With The IRS

The seven issues you possibly can take cash out of your IRA early for with out incurring an early withdrawal penalty or taxes.

The 4 issues you are able to do that trigger nasty penalties to be levied on your IRA.

The 9 issues your IRA can’t make investments in.

What is going to occur to you if the IRS catches you “self dealing” (and it’s not fairly).

How to fill out the easy type directing your IRA to make an funding so all of the income from that funding circulation again to your IRA tax free.

Why you shouldn’t do “subject to” offers in your IRA the standard method, however you are able to do them with somewhat-know, unconventional technique that’ll lead to massive income.

CD #5 – How To Shield Your self Sue-Completely satisfied Predators Whereas Making At Least 30% On Your Cash

How to use paper trusts, land trusts and private property trusts to shield you towards sue-completely happy predators who need to steal each dime you’ve utilizing the authorized system.

When to use money from your IRA to purchase actual property and when not to.

Why being a “hard money lender” is the simplest, tax-free cash you’ll ever make utilizing your IRA.

How to make at the very least a 30% charge of return, or a lot, rather more, on your IRA’s cash each time you make a sure funding that has method much less danger than the inventory market.

What NOT to do with the money in your IRA. The individuals who don’t know these “what not to do secrets” get ripped off each single time they make an funding.

Why the very last thing you need in your IRA is money!

How to contribute up to $41,000.00 a 12 months to an IRA AND get an enormous fats, $41,000.00 tax deduction on the identical time whereas nonetheless taking advantage of investments in your Roth IRA.

Apprehensive about your well being? Right here’s a neat plan the IRS got here up with for you to get your well being wants met with tax-free cash. If this doesn’t substitute your medical insurance utterly, it should definitely slash the price of it!

Okay, that’s it. You might have simply learn an in depth description of the tax-free wealth secrets and techniques on these CDs and what they’ll do for you. For those who’re in any respect in getting very, very rich, these CDs are a will need to have, and you possibly can’t get the knowledge on them wherever else, definitely not from your accountant or monetary advisor.

However Wait, There’s Extra!

As well as to the 5-CD audio system, you additionally get the 136-web page handbook I wrote and handed out on the occasion. Why must you care about this handbook?

As well as to masking every little thing I reveal on the CDs in depth, it additionally consists of all of the varieties and agreements you want to get arrange with a Roth IRA shortly and simply, and present you ways to do actual property offers inside it so you can also make certain the cash goes in tax free for all times.

All you’ve to do is fill out the easy varieties in this handbook, and cash that was taxed earlier than will turn into tax free. And, if you make investments in this System now, you additionally get the next…

Two Exceptional Free Items!

Free Reward #1: The precise IRS rules that present you simply why you actually can get rich tax free. These rules cowl the Roth IRA, SEPs, Coverdell Instructional IRAs, and Well being Financial savings Accounts (HSAs), all of that are entities you possibly can develop tax-free wealth in. With this handbook you’ll have the letter of the regulation on your aspect, and you possibly can take consolation in figuring out your tax-free wealth is completely authorized. I name it your “shut up” e-book, as a result of we refer to it commonly on the CDs to cite the regulation in case you want to present it to your CPA or different advisor who needs to problem your use of your IRA from a place of ignorance.

Free Reward #2: Confirmed Wealth Constructing Secrets and techniques Guide by “Mr. X.” As you recall, he’s the man who confirmed me all of the tax-free wealth secrets and techniques and the #1 IRA Professional in the nation. Actually, his firm is the one I exploit to administer all my IRAs, and he can get you arrange with your personal Self-Directed IRA, identical to me. On this straightforward to perceive handbook, Mr. X reveals each secret there’s to utilizing all of the IRA entities to construct everlasting and lasting wealth for you and your household, plus he supplies you all of the varieties you want to get your Self-Directed IRA arrange along with his firm, identical to me. His firm makes it really easy to get accurately arrange with no matter IRA you select. They actually do all of it for you, and this handbook exhibits you step-by-step how to get began. This $49.00 worth is yours FREE if you order now.

Now, not like many publishers, I take delight in how my product seems. Your studio-high quality recorded CDs will arrive speedily in skilled packaging and prepared for you to use.

IRAwealth

By now you’re most likely asking your self, “OK, Ron, how much is this System going to cost me?” To start with, you shouldn’t be pondering in phrases of price, you ought to be pondering funding. How a lot is it value to you to understand how to use your IRA to get rich and never pay taxes?

I can guarantee you, tens of millions, actually. How a lot will it price you should you don’t have this data? Once more, the reply is tens of millions.

Assume as soon as once more about our earlier instance about doing one deal inside your Roth IRA versus that very same deal accomplished exterior of it. Inside a Roth, you possibly can flip a home over immediately, maintain all $35,000 revenue, and instantly put that cash to work to make more cash inside your Roth.

Outdoors your Roth, you gained’t get neat the identical charge of return, and should you may, the least you’ll pay in taxes is $5,250.00 (should you maintain it for a 12 months and rely the revenue as a capital achieve). For those who flip it over instantly chances are you’ll pay as a lot as $12,250.00 should you’re in the highest bracket of earnings tax payers.

All it takes to do a deal inside your Roth IRA is a number of easy items of paper, however these items of paper are, clearly, value 1000’s.

To be blunt with you, there actually is nowhere else you possibly can go to uncover these secrets and techniques. Accountants don’t know them, legal professionals don’t know them, and monetary advisors don’t know them or in the event that they do, they don’t need YOU to know them. It took me, even with my many connections throughout the county, a very long time and a lot of cash to uncover them alone.

So, to prevent the difficulty and cash and get you began on your method to tax-free tens of millions, I’m going to cost you a good worth, not an exorbitant one. At first, I thought of charging the minimal you’d save in taxes on a median “pretty house” deal, $5,250. Now, whereas I do assume that could be a particularly reasonable funding, I’m not going to cost you that a lot, or wherever close to that a lot.

Actually, the funding for my How to Get Rich with Your IRA and Never Pay Taxes System is just $497, a lot lower than you’ll save in taxes on only one, tiny deal inside your IRA. BUT, if you order on-line now, I’ll provide you with a quick motion low cost of $200, bringing your funding down to solely $297, an immediate 40% financial savings.

Plus, you also needs to know my System additionally comes with a…

30-Day Unconditional satisfaction, 100% Cash-Again Assure.

If, for any purpose, or no purpose in any respect, you’re not utterly happy with your How to Get Rich with Your IRA and Never Pay Taxes System, merely return it in resalable situation and you’ll cheerfully obtain a whole and full refund, no questions requested. I take all the chance, and you don’t have anything to lose, besides your tax invoice. So, with out additional ado…

This is How To Order

All you’ve to do to get your fingers on this System is fill out the shape beneath beneath.

The knowledge you’ll obtain on the CDs is data you possibly can’t get wherever else, definitely not from your lawyer, monetary advisor, or accountant, and you don’t need to miss out.

You also needs to know I’m not planning on re-ordering any of those CDs for a very long time, so to ensure you’re not unnoticed, you want to act NOW! Additionally, maintain in thoughts, if you order now, it is possible for you to to declare the beneficiant 40% low cost, AND your two bonuses. All of this for less than $297!

How a lot cash can this small, one-time funding of $297.00 make you? Like I stated, should you solely do one deal, one time inside your Roth IRA, on the common revenue my college students make on a home, $35,000!, the minimal sum of money you’ll maintain through tax financial savings is an additional $5,250.

That’s a 1,056%, no-danger return on your funding which is already secured by my unconditional, 30-day, cash-again assure. Hold in thoughts, that’s IF you solely do one deal one time, however I’m betting after you do it as soon as, you’ll need to do it over and over once more, and your return on funding shall be close to infinity.

How rather more cash will that put in your, your youngsters’s and your grandchildren’s pockets? As compared, the funding for the How to Get Rich with Your IRA and NEVER Pay Taxes audio CD System is tiny, in truth, I can consider no purpose in any way you wouldn’t leap on this proper now earlier than one other second passes.

Don’t hate your self for passing up tax-free wealth each time you do a deal or write one other massive test to Uncle Sam; simply put the secrets and techniques in this outstanding System to give you the results you want, and smile all the best way to the financial institution.

I’m genuinely trying ahead to sharing these tax-free wealth secrets and techniques with you and serving to you retain each penny you earn, and I welcome you to be part of me in residing a lifetime of monetary success. Cease overpaying the federal government when you possibly can legally pay your self every little thing – Get began now, earlier than it’s too late.

Sincerely,

Ron LeGrand, Millionaire Maker and Grasp of Tax Free Wealth

P.S Take only one extra second to think about how comforting and exhilarating it will likely be watching your wealth develop 12 months after 12 months, tas free, and figuring out you and your household are safe for all times since you took motion and found IRA wealth secrets and techniques few different actual property buyers will ever know. Now, cease imaging that sort of life, order my system and get began residing it now.

IMPORTANT: This whole “Ron Legrand – How to get rich in your IRA and never pay taxes” is totally downloadable and accessible in your account

(In case of a damaged hyperlink, we’ll renew your hyperlink shortly).

Your endurance is appreciated.