What You’ll Discover in Joe Ross Spread Trading Webinar

Joe Ross – Spread Trading Webinar

WHY TRADE IN FUTURES SPREADS

You MUST KNOW!

Stop running is the biggest enemy of traders. Market direction shifts sharply against traders just as you think you’re winning. Your stop is set; you are out. You lose if the market does not move the way you expected it to. Imagine if I said that you could trade in an arena with no stop running. That would allow you to trade more easily.

How many times have there been major slippages when you entered a market that was nearly non-liquid?-existent?

My futures trading webinar will show you how you can trade so that you make profit even when the markets are not liquid due to traders waiting for an agricultural or government financial report.

If you could only spend a few hours each week choosing trades with at least 80% chance of winning, would you find trading easier?

What if I told you that trades can be found where the margin for entry or maintenance is 10% less than the margin required to non-trade?-Spread trading in the futures outright?

Futures spread trading is the most efficient way to use your trading capital in any trade. Spread Trading offers more leverage than any other kind of trading while also offering less volatility.

Do you know one of the most important secrets of trading?

Spreads are not calculated with margins correctly. What is it? During the seminar on trading spreads, you will discover it. It is a valuable secret that can make a huge difference in your trading.

Download immediately Joe Ross – Spread Trading Webinar

Spread trading is rarely mentioned in any books, on websites, by exchanges, brokers, or on the internet. It is time to discover why spread trading is so rare. You’ll be surprised.

Are you able to profit from sideways movements in the markets? Sideways markets are an opportunity to make a lot of money if you understand how trade spreads work.

This is not about option spreads. These are only a few of many outstanding features and benefits that can be obtained by spreading futures contracts against each other.

There’s more. This list is not exhaustive. Here are some of the benefits that you can expect to receive. Spread Trading Online Video Seminar©:

Market Dynamics — market dynamics will show you: where prices will probably move next; why prices move to where they do move; how far prices are likely to move; how they are moved; and who moves them. You will be compelled to trade spreads once you have all of this information.

How to stop running. Stopping is not what anyone wants.-You must fill the order of loss. Imagine yourself in a situation where you have to fulfill every order that you place on the market.

Find out why spreads exist and who uses them. You might be among them.

Find out what spreads are and why they are important.

Learn about the five categories of trades.

Learn more about arbitrage and how it spreads traders.

Spread trading is safer than trading in futures.

Spreads have the lowest margin requirements of any trading option. Spreads are even lower than trading options.

You can trade 10 spreads with the same capital as you would for one futures contract. Spreads are one of the most efficient ways to invest capital in the trading world.

Find out why spreads are more volatile than futures.

Learn how to protect yourself in limit moves.

Learn why Spreads tend to trend more frequently, more steeply and for longer durations than pure futures.

Learn why spreads require lower liquidity than outright futures.

Spread trading is less risky than other trading.

Your chances of winning a single trade when you trade forex, stocks or options are not greater than 50%. Trading spreads can increase your odds of winning by 67%.

It is more profitable to trade spreads in a falling market, than it is to trade short in straight futures.

Learn more about crack and crush spreads. They are what the big traders use, and they can be yours too.

Learn how to arrange a spread and how to place spread orders.

Learn how spread trading works. It is important to understand how to manage risk, money, and trade. These are all covered in the seminar.

Learn more about seasonality in spreads

Learn more about regression analysis spreads.

Learn about observation spreads.

Learn how to create a spread library of tradable butter spreads that can be used year round-In and Year-out.

Learn more about where to find free spread charts.

Step-By-Step how to choose spreads, determine the spread to trade, what to do about risk and how to set profit goals.

Find out which markets you are able to trade spreads.

Look for spreads acceptable to you.

Spreads trades can often be planned out months in advance.

You need to know where you can find unit values. This information is crucial for trading and charting spreads.

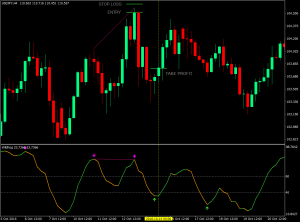

See how to use the Traders Trick™ when trading spreads.

Learn how to filter spreads and make sure you only take the best.

HAS SPREAD TRADING GIVEN YOU ACCESS TO ALL THE WONDERFUL BENEFITS?

YOU DO NOT HAVE TO MISS OUT!

THE SPREAD SEMINAR WILL BE HELD

TEACH YOU WHAT YOU MUST KNOW.

REQUIREMENTS:

You can watch my online video and all you have to do is take it. Spread Trading It is time, your computer that has internet access, and an active e-Mail address

Please note that the total size all video files is 605MB. It may take some time to download all six files depending on how fast your internet is and where you live. Because the time taken to download all 6 files can vary, we are unable to give precise figures. It is important to plan your time.

Download it immediately Joe Ross – Spread Trading Webinar

You have 72 hours (3 Days) to view the entire online seminar course. It starts at the time that you click. “play” The first video. You can watch the entire course in a total time of 5.6 hours. This gives you plenty of time to stop, review and clarify any parts, as well as to study the material thoroughly. To make it easier for you to follow along, you can also download the seminar as a PDF. It’s yours to keep forever.

I only have 3 days to view the entire seminar. If you took our live seminar on Spread Trading The seminar would last only two days. You’d have limited time to review the material and answer questions. Online seminars give you the opportunity to take in the details and repeat each section multiple times throughout the three-day period. Plus, you can ask questions via the e-mail.-You can also email us or join our forum.

Download it immediately Joe Ross – Spread Trading Webinar

Here’s What You Will Get In Spread Trading Webinar

IMPORTANT: This is it. “Joe Ross – Spread Trading Webinar” Completely Downloadable You will have access to it immediately. In the event of a broken or lost link, we will quickly renew your link. We appreciate your patience.