What You’ll Discover in Daniel Ferrera Wheels Whitin Wheels

Daniel Ferrera – Wheels Whitin Wheels

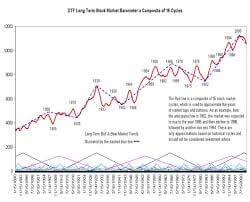

We are proud to announce the new course release by Dan Ferrera, Wheels Within Wheels: Forecasting Financial Market Cycles. Dan breaks down 16 Dow Jones Averages primary cycles and creates an Excel spreadsheet to combine them into a composite wave that closely replicates the past 100 years of market activity. (see chart below). He provides information on all cycles, possible correlations and, most importantly, projects them 100-years into the future using the DTF Barometer. This will give him a clear view of the next 100 Dow Jones Averages years.

TABLE DES CONTENTS

PART I – Special Stock Market Cycle Report

Author’s Introduction

The 18-Year Super Bull & Bear Market Cycle

The Big Picture

A Closer View of Cycles

The 42-Year Cycle

Interest Rates

The Economy

The January Effect

2002- 2102 Major Trendcycle Composite Forecast

PART II – Special Stock Market Cycle Report

Author’s Introduction

What is a Cycle?

The New Era

The Four Primary Intermediate Cycles

W.D. Gann’s Stock Market Patterns

The 10 & 9 Year Cycles

The Shorter Cycles

Putting Them All Together

S&P 100 Year Projection Using #1 & #2 Dominant Cycles

Follow the Yellow Brick Road

Download it immediately Daniel Ferrera – Wheels Whitin Wheels

Get the latest version now Daniel Ferrera – Wheels Whitin Wheels Get it now

Part III – The DTF Long Term Stock Market Barometer

16 Cycle Composite Barometer

Is Timing the Market Worth It?

The 54-Year & 12-Year Cycles in Bond Yields

Cycles In Gold

Stock Market Cycle Charts

Appendices

Appendix 1 – Garrett Torque Analysis Example

Appendix 2 – How To Create A Composite Cycle

Appendix 3 – Vectors & Phase: What is a Vector?

Appendix 4 – Wyler’s Theoretical Considerations

Appendix 5 – Dewey’s Cycles In The Stock Market

Appendix 6 – Cogan’s Rhythmic Cycles

Appendix 7 – Chase’s Economic Time

Appendix 8 – Wood’s Stock Market Time Cycles

Appendix 9 – Martin’s Trend Action

Appendix 10 – Weston’s Geometrical Chart System

Appendix 11 – Bibliography & Recommended Reading

2002, 300p. Numerous Charts & Diagrams. Includes CD ROM with all Excel Spreadsheets including all cycle calculations and charts, and the 100 year projection DTF Barometer. CD Rom also Includes 100 Years of Daily Dow Jones Industrial Average Data 1900 – Current, Daily S&P Data 1960 – Current, Daily NASDQ Data 1971- Current, Daily Cash Wheat Data 1966- Current, & Daily Cash Soybean Data 1959- Current. This data alone would cost you the same as the course. Price $450.00

CUSTOMER & EXPERT REVIEWS – BONNIE LEE HILL – MIKE JENKINS – LARRY JACOBS

After studying and using cycles in the stock exchange for 32 years, I have come around to their value. I consider economic cycles the most valuable tool that I have ever used.-A term investor has what they really need. This is what I was looking for in reading Daniel Ferrera’s new “Special Stock Market Cycle Report” To see if he could shed light on the economic outlook in the future years and whether it differed from mine. Dan’s report basically explains the long term “Super” It breaks down the bull and bear markets with examples from the past 100 year and then projects them 100 years into future. Investors would be surprised to find out what these cycles mean for the next decade and the next two-to four years. Knowledge of major highs or lows is crucial for wealth creation. The Rothschilds of Europe explicitly stated that they had accumulated all their wealth by simply following the 41-Over a century, their families have enjoyed a 42-month cycle that was full of economic activity. Dan’s study pinpoints the big highs and lows that come from very regular and dependable cycles and if you are a long term investor or mutual fund owner you will certainly want to know when these “once in a lifetime” Stock investing has many possibilities. This report also refers to the shorter term economic cycles that are more common than the longer term master cycles. These can serve as a guidepost for the future outcomes. You should not invest in the market with any long term view.-The information in this report is important for term funds. It’s presented as a fairly basic analysis that will serve as a stepping stone to more sophisticated cycle analysis but for the average investor if you don’t know these basic fundamental cycles you will be at a significant disadvantage in the investment arena. It is worth the small investment.

Download it immediately Daniel Ferrera – Wheels Whitin Wheels

Michael S. Jenkins, Stock Cycles Forecast

“Mr. Ferrera has put together a very unique stock market report that clearly shows two dominant long term cycle patterns that have predicted every major Bull & Bear Market Trend for the past century. He then projects this pattern 100 years into the future. I would highly recommend this report to anyone that invests in the US Stock Markets”.

Bonnie Lee Hill, Dallas, Texas

Long-Term investing “Buy & Hold” Philosophy can be a great strategy to accumulate significant wealth in stock market. However, the strategy and length of the holding period must reflect the specific market cyclic action, and not any rigid rules. “never sell” Approach that refuses to adapt to market changes You bought the product for the long term-term in 1928 and failed to sell in early October 1929, it took you until 1953 just to break even, and that’s assuming the stocks you bought were even in business 25 years later. For the long-term-In 1966, term was granted and it was held. You had to work for 16 years before you could break even, not accounting for the severe economic inflation we experienced. Mr. Ferrera’s report clearly shows how and when these long term investment opportunities present themselves with both historical charts and future projections all the way out to the year 2108. This is my best investment. The price should be higher, in my opinion. V. S.

Mr. FerreraWe have published several articles in magazines by. He has created a stock market report that shows clearly how the two dominant long-term stocks are.-term cycle patterns have predicted every major Bull & Bear Market for the past century. Mr. Ferrera The cyclic model is projected graphically 16 years in the future, and then described how the stock market will unfold over the next 100 years-years! Never in my many years of working at Tradersworld Magazine have I seen anything quite like it! This information is absolutely invaluable for anyone that invests in the equity markets, whether it’s on their own or through a company retirement plan. You Can See It Too… In this report, you will literally “see” How and why the markets crashed again in 1972 and 1929. The market traded sideways between 1932 and 1947, 1974 and 1982. It will become clear why the stock markets reached their peak in 2000 and what the future holds for them until 2018.

Get your instant download Daniel Ferrera – Wheels Whitin Wheels

Here’s what you can expect in the new book Wheels Whitin Wheels

IMPORTANT: This is the entire “Daniel Ferrera – Wheels Whitin Wheels” It is totally Downloadable You will have access to it immediately. In the event of a broken or lost link, we will quickly renew it. We appreciate your patience.