What You’ll Uncover in MarketCalls.in Tradezilla 2.0

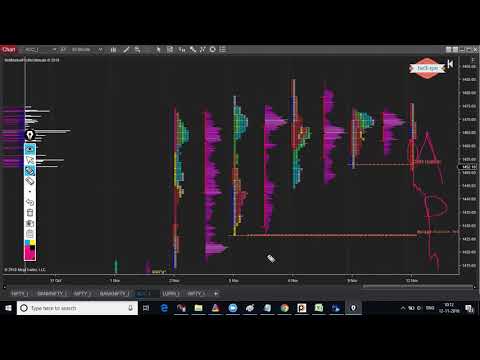

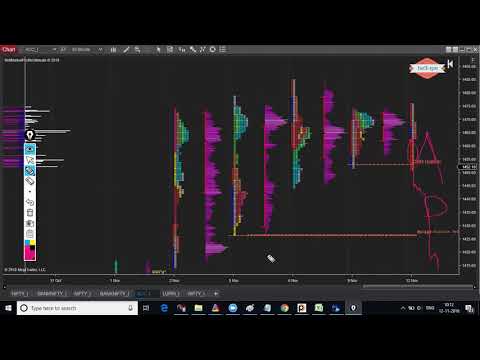

This Mentorship program solely focuses on Market Profile and Orderflow instruments utilizing Ninjatrader 8 software program to make the merchants assist perceive the target approach of look into brief-time period and intraday buying and selling alternatives.

File dimension: 12.49GB

MarketCalls.in – Tradezilla 2.0

-

This Mentorship program solely focuses on Market Profile and Orderflow instruments utilizing Ninjatrader 8 software program to make the merchants assist perceive the target approach of look into brief-time period and intraday buying and selling alternatives.

-

-

The course is designed in such a approach that even merchants who’re new to technical evaluation can perceive because the course begins from the scratch of market profile and order-move ideas.

-

-

Market Profile Fundamental

-

-

Introduction to Public sale Course of and Public sale Market principle

-

Introduction to Market Profile / Quantity Profile

-

Fundamental Constructing Blocks of Market Profile (TPOs, Preliminary Stability, Worth Space, Level of Management, Tails, Vary Extension)

-

Significance of Stability and Extra

-

Significance of Level of Management and Worth Space

-

Market Profile Construction and Profile Distribution sorts

-

Significance of single prints

-

Understanding poor Buildings, Poor Lows/Poor Excessive, Weaker Low, Weaker Excessive

-

Significance of Anomalies and Emotional profile construction

-

Significance of 45 diploma line

-

Significance of Failed Public sale

-

Significance of Spikes and Gaps

-

Understanding the conduct of Market Members

-

Market Opening confidence Varieties

-

Significance of One timeframing and the underlying market confidence

-

-

Market Profile Intermediate

-

-

Multi-timeframe High Down Evaluation (barcharts)

-

Multi-timeframe quantity profile evaluation

-

perceive Market Confidence for routine day buying and selling or positional buying and selling

-

Market Profile Key Reference ranges (Intraday & brief-time period)

-

Introduction to Buying and selling Stock

-

The place buying and selling cash preserve their cease-loss

-

Establish Sturdy Public sale Course of and Weaker Public sale Course of

-

Signature G2/G3 Patterns, R-PPOC ranges, AB Poor lows

-

Look above the steadiness and fail, Look above the steadiness and speed up

-

put together for a buying and selling day(High Down evaluation, Pre Market Evaluation)

-

Guidelines for Day Buying and selling preparation, Key ranges to watch)

-

Initiative Vs Responsive Auctions

-

spot acceptance/rejection at key reference ranges.

-

-

Market Profile Superior

-

-

30+ Intraday Buying and selling Methods

-

Market Profile Positional Buying and selling strategies

-

High/Backside Formation Setups

-

Quick Protecting/Lengthy Liquidation Patterns

-

suppose from Exponential odds

-

handle threat whereas taking a view utilizing market profile

-

Stay Case Research on Nifty/Financial institution Nifty and High Nifty scrips

-

-

Ninjatrader 8 and Market Profile Settings

-

-

Understanding Ninjatader 8 and Datafeeds

-

Understanding Ninjatrader 8 settings

-

setups charts and optimum TPO dimension

-

Bell Market Profile Professional and Bell Market Profile Final Settings

-

use Bell Market Profile Final Scanners

-

Study to make use of Bell Dynamic Profile Settings

-

use Bell Development Analyzer together with G2/G3 patterns

-

-

Orderflow Buying and selling Methods – Fundamental

-

-

Fundamental Constructing Blocks of Orderflow, Delta, Cumulative Delta

-

Totally different illustration of Orderflow views and its significance

-

Options of Bell Orderflow Final and Settings

-

Lesson 4 : The dedication of Merchants and Contract Reversals Defined

-

Varieties of Knowledge Distributors and their information codecs

-

Distinction between Stage 1, Stage 2, Stage 3 and Tick by Tick Feed

-

How Orderflow is plotted utilizing uptick/downtick or BidxAsk strategies

-

Distinction between Orderflow and Bookmap

-

Introduction to Market Depth 101

-

Distinction between liquidity and quantity

-

L: How excessive liquidity and low liquidity impacts the markets

-

What to Interpret from Excessive quantity nodes and Low quantity nodes

-

Institutional Execution methods

-

Rules of Orderflow

-

Significance of Stacked Momentum Patrons

-

-

Orderflow Buying and selling Methods – Superior

-

-

How Sensible cash positioning and Unwind their positions

-

spot cease-searching / The place most merchants preserve their stoploss

-

Establish Initiative Drive and Absorption auctions

-

Establish Development reversals for scalping utilizing orderflow

-

Establish very brief time period assist and resistance ranges

-

Establish failed breakout buying and selling methods for Intraday buying and selling

-

Establish development breakout buying and selling methods for Intraday buying and selling

-

Momentum Buying and selling and Momentum Exhaustion Buying and selling Patterns

-

mix momentum exhaustion with Delta Divergence

-

Recognizing Cumulative Delta Divergence

-

Establish Trapped Patrons or Trapped Sellers from Orderflow

-

make use of Unfinished enterprise ideas

-

interpret R-Delta and MR – Indicators from Orderflow

-

Which timeframe to make use of in Orderflow for scalping/intraday buying and selling

-

Buying and selling notes and Finest Orderflow buying and selling practices

Get MarketCalls.in – Tradezilla 2.0 obtain instantly on AMZLibrary.com!

IMPORTANT: This whole “MarketCalls.in – Tradezilla 2.0” is totally downloadable and accessible in your account

(In case of a damaged hyperlink, we are going to renew your hyperlink shortly).

Your persistence is appreciated.