What You’ll Discover in MarketGauge ETF Sector Plus Strategy

MarketGauge – ETF Sector Plus Strategy

Trade ETF Sector Trends Like A Professional

To increase your wealth and income.

No matter what the general market trend is!

Decades of…

- Trade experience

- Market research is a key component of market research.

- Technological development

…have been combined to give you access to trading strategies historically reserved for only the savviest hedge funds!

Profiting from this strategy can be as simple as 3 ETF positions!

Register Now you’ll immediately receive the top three ETF’s You can find the“ETF Sector Plus Strategy” has chosen to dramatically outperform current markets.

Start your Full Year Membership Today

YES, I want to be part of this exclusive program so that I’ll receive immediate access to the ‘ETF Sector Plus Strategy’ Before the price goes up

Here’s What I’ll Receive With My Membership…

One Year Full Access to:

| Email and Text Messaging Early Notice Trading Alerts These alerts will let you know exactly when and how you can follow trades ‘ETF Sector Plus Strategy’. This will allow you to have the new trade ideas on the same day as the strategy is entered into the trade. |

| The ETF Sector Plus Model Portfolio You can see exactly what is happening in the model portfolio. You’ll be able to easily track all open positions, recently closed positions, even the daily movements of the models underlying ETFs, and more.You’ll love this detailed monitoring if you’re curious about which sector trends and trade opportunities are gaining and losing momentum! |

| Daily Email Updates & A Weekend Strategy Review Daily emails keep you updated on the current Model Portfolio’s open positions, so you never miss a trade. This email is in addition any trade alert email. PlusA weekend email will teach you more about the market and the model. |

|

A live monthly training webinar Download immediately MarketGauge – ETF Sector Plus Strategy |

Automated ETF Sector Plus System

Incredible Returns in Minutes per Week

The ability to profit from the market can be used by traders of all abilities ETF Sector Plus Strategy by spending only a few hours a week to execute trades because…

| The trading model calculates the exact entry and departure times of trades So there is no need to analyze. | |

| All trade alerts can be received at the end the day. You can place your orders even before the market opens. | |

| Three positions are the maximum in a model portfolio. There is not much management. |

Why The 2015 Pullback In The Models’ Equity Curves

This is a huge opportunity now!

We’re not going to try to hide the fact that 2015 was a difficult year for the ETF Sector models, but the reasons behind it are over and very unusual, here’s why…

The 3-Day crash between August 19 and August 24th. In fact, on 8/19, right before the S&P’s historic 3-day slide our Moderate model was up about 1% for the year and in line with the market’s performance.

Unfortunately, our sell signals took place on 8/21. This means that we have to exit all long positions by the following day, which was the exceptional gap on the 24th. This caused some unusually poor exits.

This extreme gap caused the model’s switch to a shorter position at the same extreme level. The model was then stopped at a loss for the next few months.

In the prior “quick” Corrections The model was not in the best position before the selloff and it also had defensive positions, such as gold or bonds, which made it less damaging.

The model is designed to exploit market declines lasting longer than three crash days. However, if the market continued lower, the model would have done well. Additionally, had the crash happened one day later, the models’ losses would be half of what they currently show.

In 2015 and 2016, the models were sold. This resulted in a new cycle. Sector Leadership, and 2016 was a great year for the model. The year is far from over!

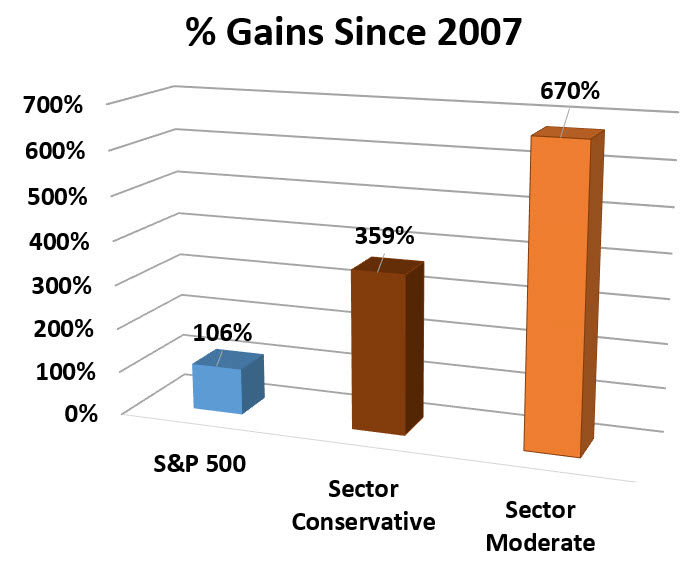

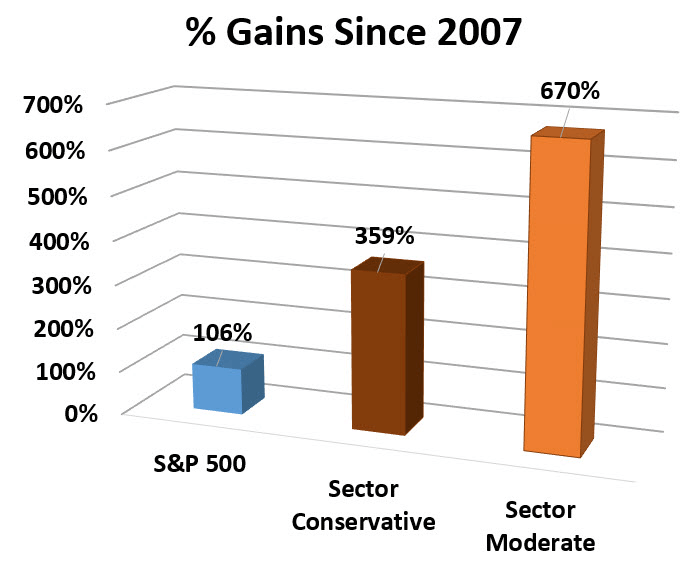

Its past performance, up to 2015, shows that it can easily and significantly outperform any market trend over time.

It couldn’t be simpler to receive trade alerts. Here’s how a trade alert might look:

“ETF Sector Plus Strategy Trade Alert:

Buy GDX at the market on the open Monday 2/1/2016”

When you become a member you’ll be able to instantly replicate the model’s portfolio so you can start immediately to have your trades track the performance of the model’s equity curve!

You’re Also Protected By Our

100% Performance Guarantee

Our 100% performance guarantee protects your purchase today.

If you are interested in the ETF Sector Plus The Model Portfolio has not provided a positive return for your year as a member. After that, you get the next year free.

Here’s what you can expect in the new book ETF Sector Plus Strategy

IMPORTANT: This is the entire “MarketGauge – ETF Sector Plus Strategy” It is totally Downloadable You will have access to it immediately. In the event of a broken or lost link, we will quickly renew it. We appreciate your patience.