What You’ll Discover in Robert (Bob) Steele Accounting Bonds Payable, Notes Payable, Liabilities

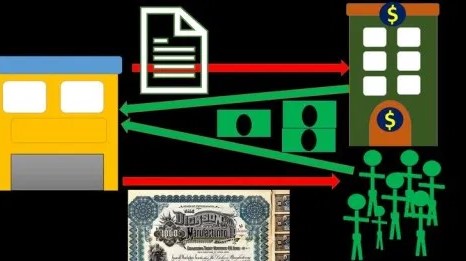

Bonds The concepts of liabilities, payables, and notes payable will be introduced from a corporate perspective. It will also show how to record the issuances of bonds and notes payable. File Size: 7.1GB

Robert (Bob) Steele – Accounting – Bonds Payable, Notes Payable, Liabilities

Bonds Payable, Notes payable, and Liabilities will present the concept of bonds from the corporate perspective. It will also show how to record the issuance or notes payable.

We will be discussing the journal entry to issue bonds at par, at a discounted, and at premium.

This course will provide information in multiple formats about present value calculations. Partly because present value calculations can be explained in many ways, learners often find them confusing. We’ll discuss the different ways we can calculate present value, and when we would use them. We will use formulas, algebra, present value tables and Microsoft Excel functions to calculate our present values.

We’ll discuss the issues price of bonds, and how it differs from the face amount or par value.

Get your instant download Robert (Bob) Steele – Accounting – Bonds Payable, Notes Payable, Liabilities

The journal entry relating to the retirement of a bond at maturity and before maturity will be covered in this course.

We will create amortization tables for notes payable and record journal entries relating to the taking out of an installment note. The amortization tables allow us to track the correct transactions in making payments on a note payable. They also give us an idea of how interest is calculated and what it is.

This course will help you to simplify your data entry by adjusting entries in your accounting system.

We’ll discuss how to create the liability portion of the balance sheet, breaking down current and long term.-Term portions. We will talk about different methods for recording the current and long portions.-term portion of the installment notes

Get your instant download

This course will talk about different types and characteristics of bonds.

We will show you how to amortize discounts and premiums using different methods, including the straight-Discuss the pros and cons for each method: effective and line method.

This course will discuss the differences between an operating and capital lease. It will also explain when a lease must recorded as a Capital Lease.

A comprehensive problem will be presented to allow us to step back and consider the whole accounting cycle.

This course will not only include instructional videos but also downloadable materials.

• Downloadable PDF Files

• Excel Practice Files

• Multiple Choice Practice Questions

• Short Calculation Practice Questions

• Discussion Questions

The PDF files can be used to download information that we can use offline as well as to guide us through the material.

Excel practice files are preformatted so that you can concentrate on the adjusting process.

Multiple choice example question helps us improve our test-Reduce the amount of information in multiple choice questions to improve skills and discuss how to approach these questions.

Short questions for calculation help reduce complex problems down to a shorter format that can be used in multiple choice questions.

Discussion Questions will give students the opportunity to talk about the topics with their instructors. It is often very beneficial for students because it allows them to view the topic from different perspectives.

Whom will we learn from?

You will be taught by someone with technical expertise in accounting concepts and software like QuickBooks. They also have experience teaching and putting on curriculum.

You’ll learn from someone who is a:

• CPA – Certified Public Accountant

• CGMA – Chartered Global Management Accountant

• Master of Science in Taxation

• CPS – Certifies Post-Secondary Instructor

• Curriculum Development Export

As a CPA, the instructor has dealt with many accounting problems and helped to resolve them for clients at all levels.

The instructor is a CPS teacher and professor. He has worked with many students in accounting, business and business applications.

Instructors also have a lot of experience in designing courses. They know how students learn best and how they can help them achieve their goals. The instructor’s technical course design experience is a benefit. It allows them to plan logically and solve problems that are related to using software such as QuickBooks Pro.

This content includes:

· How to record the issuance of bonds

· How to record bonds issued at a premium

· How to record bonds issued at a discount

· Present value (PV) Calculations Using Formulas

· Present value (PV) Calculations Using Tables

· Present value (PV) Calculations Excel

· Calculate Bond Issue Price

· How to record bond retirement

· Description of notes payable

· How to create an amortization table

· Adjusting entries for notes payable

· How to record current and long-Liability for term

· Types of bonds and bond characteristics

· Calculate the effective amortization method

· Explain what a capital lease and operating lease is

· Comprehensive accounting problem

This course is designed for the following:

Accounting Students

Owner of a business

Anyone who wants to learn accounting

IMPORTANT: This is it. “Robert (Bob) Steele – Accounting – Bonds Payable, Notes Payable, Liabilities” Completely Downloadable And Available In your account

(In the event of a broken or lost link, we will renew your connection shortly.

Your patience is greatly appreciated.