What You’ll Uncover in Scott Letourneau Sales Tax System Voluntary Tax System

Scott Letourneau – Sales Tax System – Voluntary Tax System

One Easy System to Get Your FBA Enterprise in Sales Tax Compliance

Consideration all FBA Sellers!

Learn the necessary info under to find…

The SMART and EASY Option to STAY Tax Compliant, PAY ZERO SALES TAX and GROW Your Amazon Enterprise for Lengthy Time period

Ongoing Success!

Put An Finish to All Your Tax Worries With This Easy-To-Use Complete Compliance Sales Tax System.

In the case of dwelling the net freedom life-style, Amazon has develop into a extremely popular platform for many individuals, households and web entrepreneurs.

It has not solely created one of the crucial superior success networks on the earth by storing, packing and delivery your merchandise to your buyer… it has additionally offered Amazon sellers with a number of benefits.

A few of these embody easy accessibility to its HUGE market, two-day quick supply, safe funds and extra.

Because of this, this wonderful and worthwhile alternative has skyrocketed on-line gross sales to virtually $190 Billion in the previous few years alone.

Till lately, customers might usually purchase merchandise on-line for much less by saving on gross sales tax, however consequently, states misplaced BILLIONS of $$$ in uncollected gross sales tax income.

This induced most States to ‘get in’ on the enormous income pie, and started charging all on-line ecommerce companies gross sales tax, impacting EVERYONE doing enterprise on the web, together with Amazon FBA sellers.

These new tax insurance policies grew to become often known as the “Amazon laws”, and since they’ve been launched, most FBA Sellers and on-line enterprise house owners sadly really feel like they’re actually ready to be hung… it’s only a matter of time.

The rationale for it’s because as an FBA Vendor or on-line enterprise proprietor, you could now;

- COLLECT gross sales tax within the correct amount.

- REMIT that tax to the correct state company.

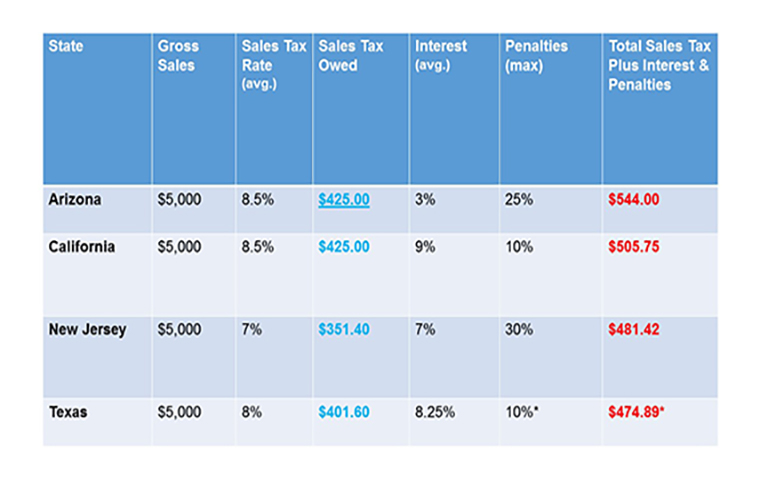

When gross sales tax turns into overdue, it then turns into a legal responsibility that includes of three issues; gross sales tax PLUS curiosity PLUS penalties, totalling as much as a MASSIVE 41%.

SALES TAX = 8%

SALES TAX = 8%

INTEREST = 3%

PENALTIES = 30%

TOTAL = 41%

Right here’s a fast instance of a gross sales tax legal responsibility owing on simply $5,000 in gross sales in several States:

As an FBA vendor (or any on-line enterprise proprietor), state governments maintain YOU chargeable for being in COMPLIANCE.

Should you’re a longtime FBA Vendor and have NOT collected and paid your gross sales taxes, you’re HEAVILY beneath water and have to act instantly.

Failing to Accumulate and Remit Sales Tax While you Have been Required to Means You’ll be Obliged to Pay the Sales Tax Legal responsibility Out of Your OWN POCKET!

For this reason operating what you are promoting whereas being out of compliance is equal to FLUSHING Your Earnings Down the Rest room!

Selecting to disregard the duty of turning into compliant doesn’t free you from being indebted to the gathering company of that individual state… and, it will get worse…

Neglecting to Pay the Excellent Tax Legal responsibility Might Not Solely Ship Your Enterprise Into Liquidation however Can Additionally Put you at Private Danger of Chapter!

The State Sales Tax Departments have powers to train their rights and take authorized motion towards you to recuperate the quantity owing, plus penalties and curiosity.

Right here’s a Typical Sales Tax Audit Situation:

Let’s say you’re an Amazon FBA vendor and also you fail to gather or remit gross sales tax in one of many FBA states, nothing might occur at first, and after a yr or two with no audit, it’s possible you’ll incorrectly assume that you simply’re in compliance.

BUT…

Just a few years later, when the state tax company finally searches what you are promoting and does a guide audit, you’ve now entered their taxation audit course of and are legally sure to co-function, collaborate and comply.

At this level, the gross sales tax auditor would require you to pay the uncollected taxes instantly with out hesitation (plus prices). The longer you are taking to pay, the larger the quantity you’ll be pressured to pay in the long term.

Anybody Who’s Been Audited from the Tax Division Will Confess its A Very Onerous Battle to Recuperate From.

In an ideal world, you’ll get audited within the first yr of enterprise, conserving your taxes and penalties down.

Nevertheless, we’ve seen many instances taking 7-10 years and even longer for audits to lastly attain companies with a nasty shock.

At that time, it’s usually too late for enterprise house owners to recuperate as a result of the tax company assesses each single transaction from day one, which usually accumulates too large of an quantity for the enterprise proprietor to pay, inflicting the destruction of that enterprise plus private litigation.

The place and When Does Sales Tax Have to be Paid?

You’ll want to acquire and remit gross sales tax when you may have nexus. No nexus? No drawback. You’re off the hook for gross sales tax.

Should you HAVE nexus nonetheless, then gross sales tax is your duty so long as you proceed to commerce in an FBA state.

What’s nexus?

It’s only a fancy method of claiming you’re obliged to gather and pay gross sales tax by the tax workplace in a given state.

Principally, you may have nexus in each state the place what you are promoting advantages from that state’s companies or infrastructure.

Examples are utilizing that state’s roads or bridges, sending your employees there for any enterprise motive, and/or storing merchandise in a warehouse in that state (sure for Amazon sellers).

For you as an FBA enterprise proprietor, usually talking, you may have nexus (tax legal responsibility) not less than in your house state the place you reside and in addition the states the place your merchandise are warehoused.

Notice: There are solely 5 states within the US that don’t have nexus:

- Alaska

- Montana

- New Hampshire

- Delaware

- Oregon

If you’re NOT in one among these states and use Amazon’s FBA service, then you may have gross sales tax nexus and are required to gather and remit gross sales tax in what you are promoting.

Behind on Sales Tax?

You probably have been promoting for six months or longer, and have NOT collected or remitted gross sales tax, you’re not alone. That is frequent for companies of their first few years of buying and selling. It’s additionally possible you had the unsuitable info and didn’t even know that amassing and remitting gross sales tax was required.

The BAD NEWS is that NOT stepping into COMPLIANCE ASAP is a monetary catastrophe ready to occur and intensely detrimental to what you are promoting.

Every Day you’re NOT Accumulating and Remitting Sales Tax within the States The place You Nexus, you’re Accountable for the Sales Tax That’s Accruing.

Sale Web page: http://www.salestaxsystem.com/sp/34519-salestaxsystemcom-sales-page

IMPORTANT: This complete “Scott Letourneau – Sales Tax System – Voluntary Tax System” is totally downloadable and obtainable in your account

(In case of a damaged hyperlink, we’ll renew your hyperlink shortly).

Your endurance is appreciated.