The Complete Finance & Valuation Course – Kenji Farre & Michael Quach

What you’ll learn

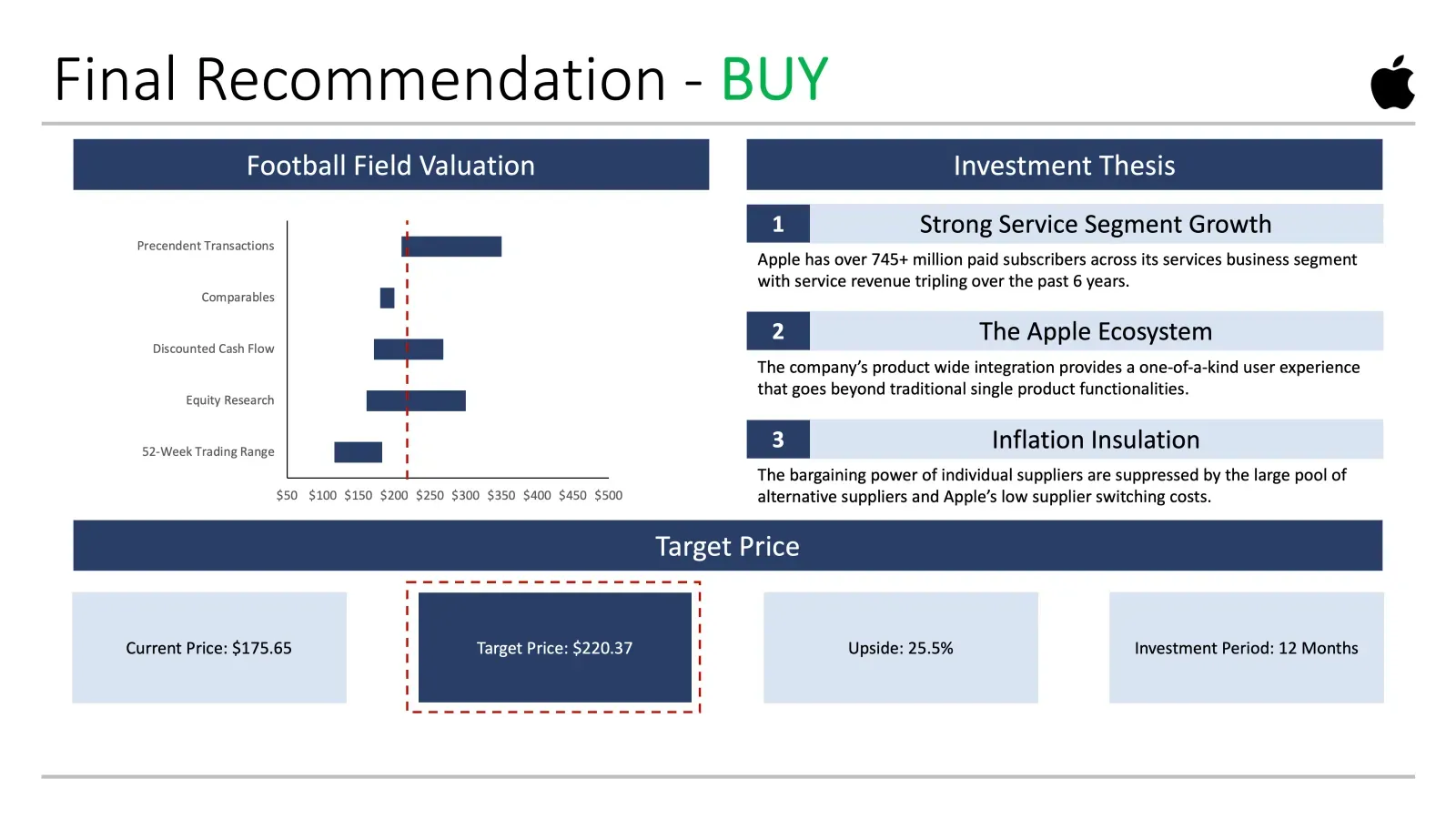

This course will teach you the basics of financial accounting, finance, and how to perform the three main valuation methods: Discounted Cash Flow, Comparable Companies, and Precedent Transactions – all on Excel. Throughout the course, you’ll learn the theory, followed by practical exercises in the form of case studies to replicate the type of work you may encounter as an intern or full-time working professional. Case studies range from forecasting a company’s financial statements, to creating full valuation models on real companies such as Apple or Adobe.

- 80+ High Quality Lessons

- Downloadable Excel and PDF files

- Full Valuation on Adobe Using Real Financial Statements

- Lifetime Access on Any Device

Who are these courses for?

-

University Students

If you’re a college student looking to secure an internship or full-time job in a top tier business, finance, or investment firm, these courses are for you.

-

Working Professionals

If you’re a working professional looking to level up your technical career skills, these courses are for you.

-

Career Switchers

If you’re looking to boost your technical skills to better your chances of switching into a business or finance role, this course is for you.

Learn the core valuation methods

This course walks you through the fundamental valuation techniques used at the top Fortune 500 institutions across the globe. Ranging from the comparable companies and precedent transactions analysis to a full built-from-scratch discounted cash flow analysis, there are valuable lessons for everyone!

Learn using real-life finance scenarios

The valuation exercises in this course are applied to real, publicly-traded companies. This gives students tangible end products that replicate real finance deliverables used to make insightful and thoughtful investment decisions. Use this course to gain demonstrable modeling experience that can elevate any resume or CV.

Practical lessons applicable to real business & finance opportunities

This course is specifically tailored for current or aspiring professionals in business, finance, or investment oriented roles. This includes investment bankers, financial analysts, management consultants, or business analysts among others.

Course Curriculum

- Course Introduction

- Excel Computer Settings

- Course Resource: Excel Shortcuts

- Course Resource: Excel Formulas Glossary

- Course Resource: Finance and Accounting Cheat Sheet

- Course Resource: Finance and Valuation Glossary

- Common Interview Questions in Finance

- The 3 Financial Statements

- The Income Statement

- Apple Income Statement Analysis

- The Cash Flow Statement

- Apple Cash Flow Statement Analysis

- The Balance Sheet

- Apple Balance Sheet Analysis

- Building a Cash Flow Statement Steps

- Case Study: Building a Cash Flow Statement from Scratch

- Financial Accounting Quiz

- Introduction to Financial Ratios

- Profitability Ratios

- Profitability Ratios Exercise

- Liquidity Ratios

- Liquidity Ratios Exercise

- Activity Ratios

- Activity Ratios Exercise

- Leverage Ratios

- Leverage Ratios Exercise

- Finance Ratios Quiz

- Case Study: Analyzing Company and Industry Ratios

- Excel Financial Modeling Best Practices

- 3 Statement Model Introduction

- Gathering the Relevant Data

- Setting up the Income Statement

- Filling in the Income Statement

- Setting up the Balance Sheet

- Filling in the Balance Sheet

- Income Statement Forecast

- Scenario Analysis

- Scenario Analysis Assumptions

- Income Statement Forecast Assumptions

- Building a Dynamic Model

- Balance Sheet Assumptions

- Filling in the Balance Sheet

- Fixed Assets Schedule

- Debt Schedule

- Retained Earnings Assumptions & Forecast

- Cash Flow Statement

- Final Edits & Summary

- Discounted Cash Flow Introduction

- Time Value of Money

- Time Value of Money Quiz

- Free Cash Flow

- Enterprise Value & Equity Value

- Enterprise Value and Equity Value Quiz

- Weighted Average Cost of Capital (WACC) Pt 1

- Weighted Average Cost of Capital (WACC) Pt 2

- Optional: Advanced Beta Calculation Method

- WACC Quiz

- Discounting Cash Flows

- Treasury Stock Method & Implied Share Price

- Treasury Stock Method Quiz

- Terminal Value & Sensitivity Analysis Pt 1

- Sensitivity Analysis Pt 2

- Optional: Goal Seek Analysis

- Adobe Discounted Cash Flow Introduction

- Optional: Methods for Forecasting Revenue

- Revenue Scenario Assumptions

- Revenue Forecast

- Cost Assumptions & Forecast

- Fixed Assets Schedule

- Calculating Unlevered Free Cash Flow

- Cost of Debt (WACC Pt 1)

- Cost of Equity (WACC Pt 2)

- Implied Share Price (Growth Perpetuity Method)

- Implied Share Price (Exit Multiple Method)

- Sensitivity Analysis

- Comparable Companies Analysis

- Comparable Companies Analysis Quiz

- Gathering the Comparable Companies Financials

- Calculating an Implied Share Price

- Creating a Dynamic Comparable Companies Model

- Precedent Transactions Analysis

- Precedent Transactions Quiz

- Precedent Transactions Exercise

- Valuation Football Field

- What is a Stock Pitch

- Stock Pitch Presentation

- Next Steps

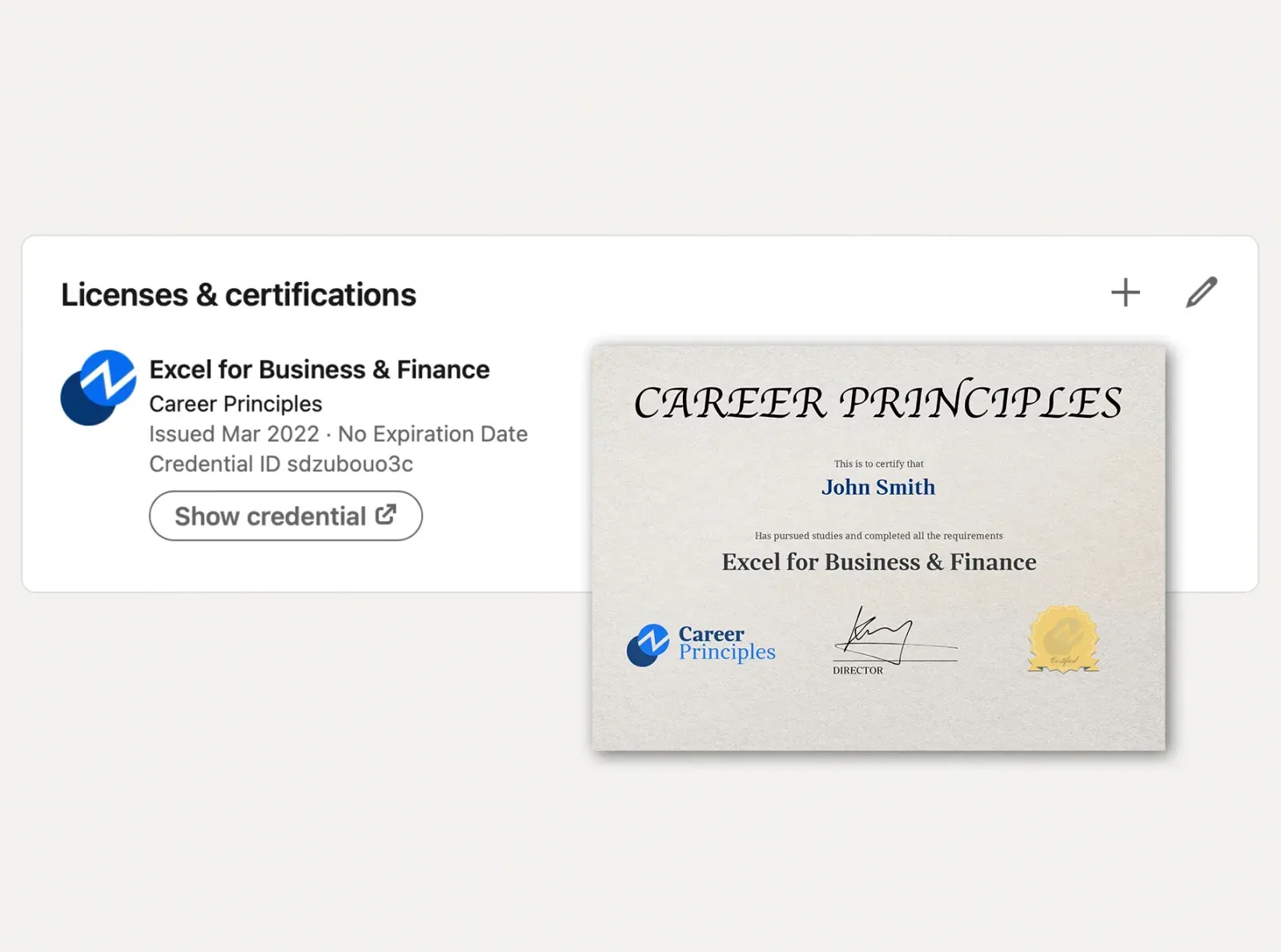

Impress recruiters with your resume

Upon completion of all course lessons, you will receive a digital certificate with your credentials. Furthermore, you can add it to your LinkedIn to show your skills to recruiters!

Reviews

There are no reviews yet.