What You’ll Discover in The Investors Syndicate Annual

The Investors Syndicate – Annual

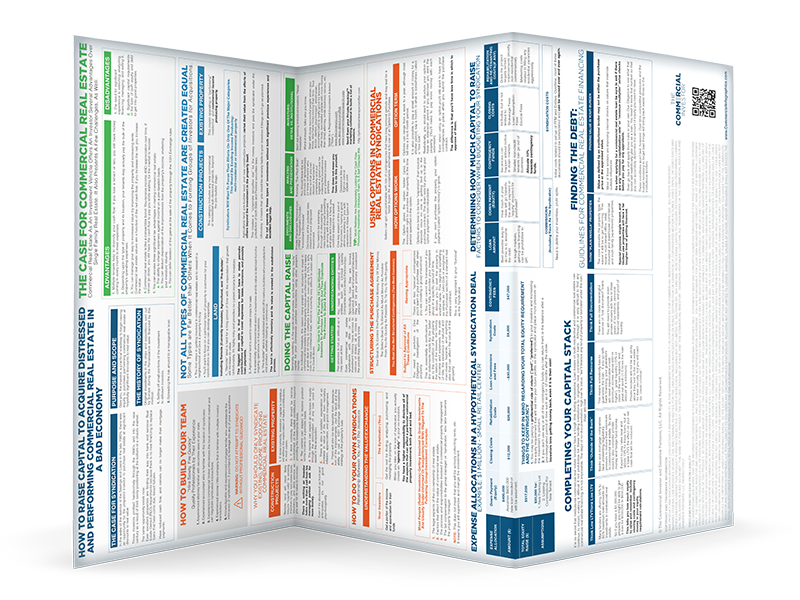

- You can easily raise capital for 7 or 8-figure deals.

- You can grab a distressed multifamily or office building and seize it!

- Flip high dollar deals for massive profits… without ever using a dime of your own money?

- Residential is much more competitive.

- Thinner deal margins.

- Federal regulations and rules bind residential investors at their ankles.

- It’s much easier to raise capital for commercial deals than for residential.

- It is more dangerous to live in a residential area.

- Scalability.

- The It is false to believe that residential investment is easier, more time-consuming, and requires less paperwork.

- Doing deals in residential — a challenging federally regulated and constricting environment where you tie up your cash for months on end, thus limiting the number of deals you do with just a mediocre payoff…

- Or in commercial — wisely building a viable high fee, high margin, high cashflow, high profit How can you run a successful business while also creating long-term wealth?

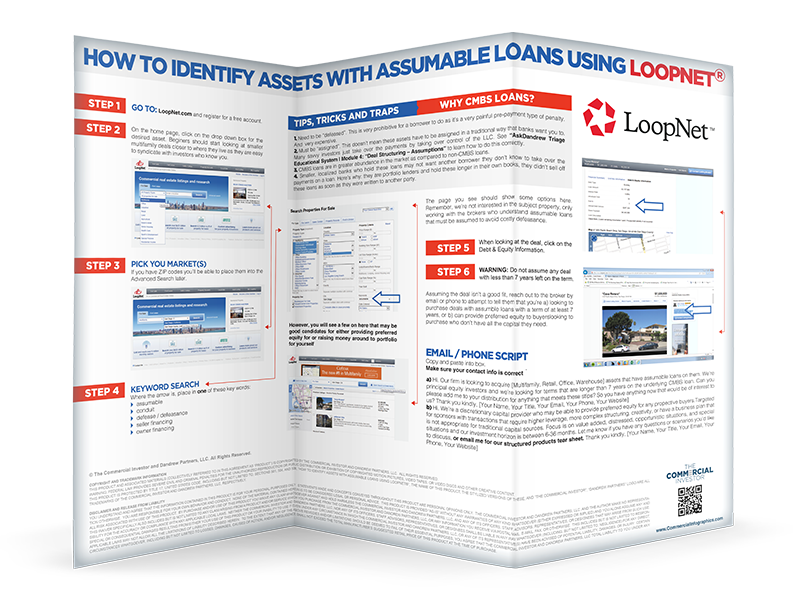

- Owners are behind on payments…

- The property is in foreclosure or bankruptcy…

- It’s in REO at the bank…

- It is necessary to make repairs to bring the building back to its original state.

- As their loans become due, sponsors are silently begging for bridge financing

- Owners don’t know how they can raise capital to finish the project.

- For a deal to be closed, you will need $1 million

- The defaulted note is held by banks and they must remove it from their books

- Partners want to be taken out of the deal… IMMEDIATELY, IF NOT SOONER

- Loans need to be paid off because they’re due or past due

- Professional Network

- Intellectual capital

- Training and experience

Expert Network Center

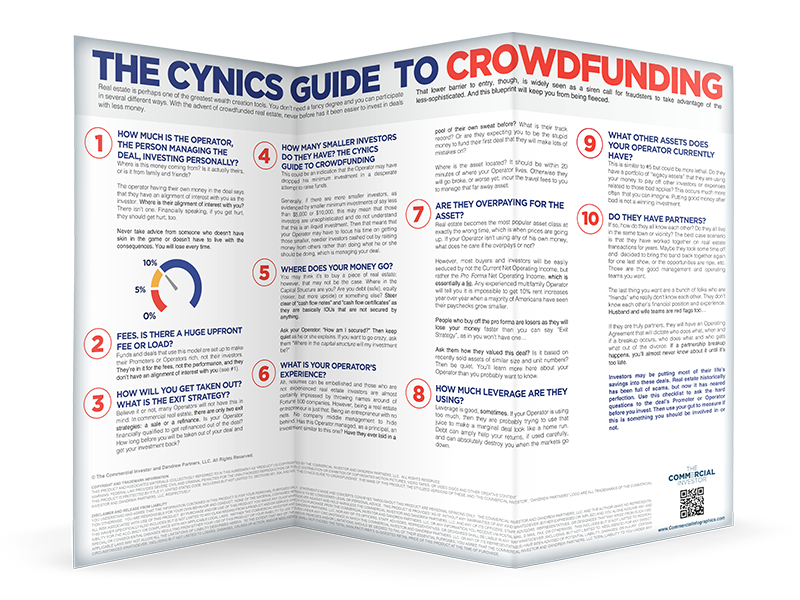

You guessed it… Bad information!

- The It actually works!

- The You need to create value for your business.

- The You can put money in the bank by buying stuff.

- The You can make stuff last for many years.

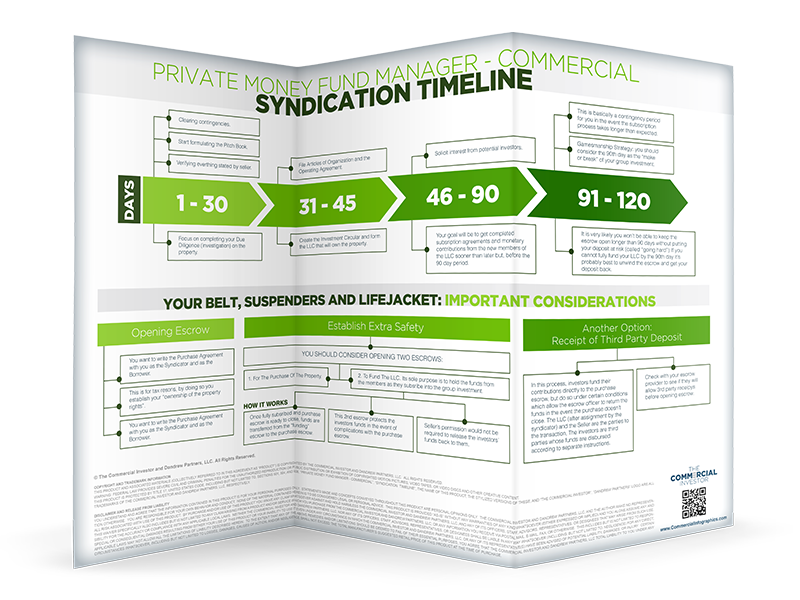

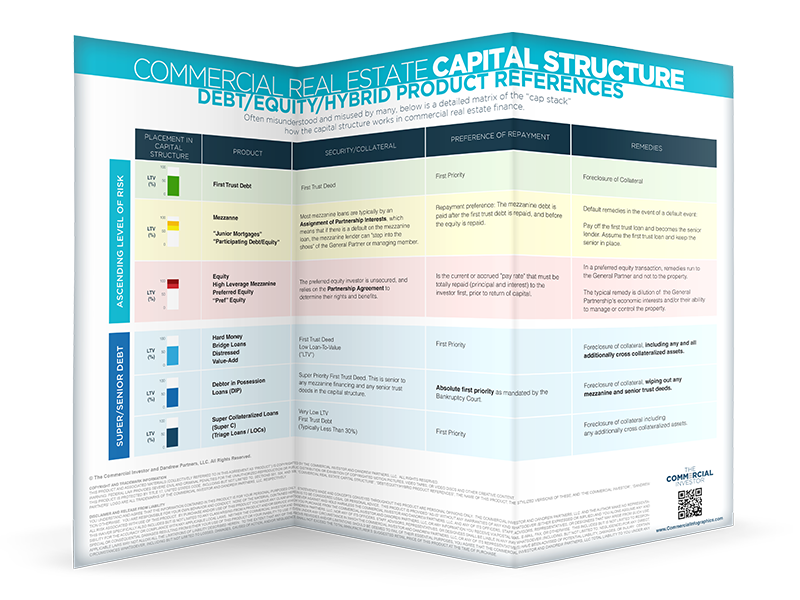

- Capital Formation: How to Raise Capital ON DEMAND in Your Deals

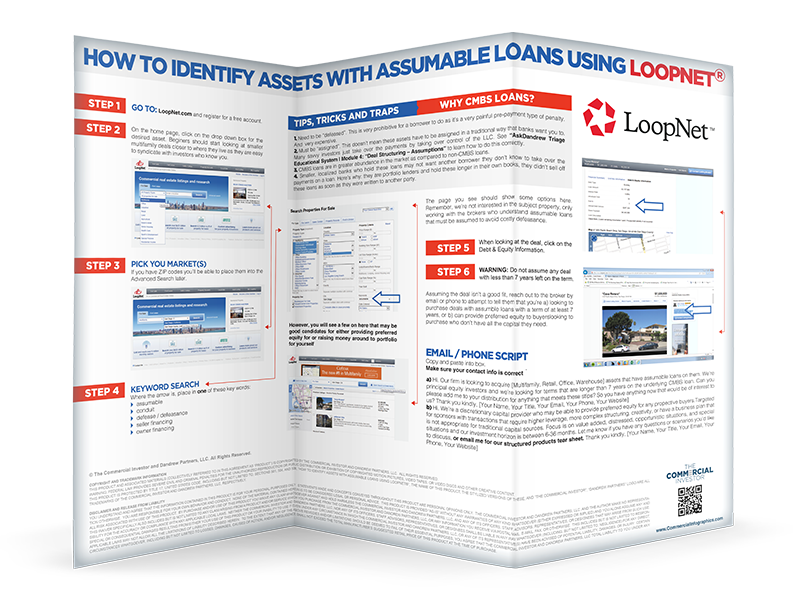

- Asset Arbitrage: What do the institutional players say? “wholesaling” deals

- Deal Making and Gamesmanship – Matching capital with an asset

- Capital Placement: Incorporating capital from Wall Street companies into YOUR deals

- High-Paid Consulting: High Salary or High Fee? Your choice

- Deal structuring: Make big money by finding solutions where no one else is able

- Cross Collateralization Strategies

- Pitching Institutional Investors

- Bankruptcy – Debtor in Possession Financing Secrets

- Private Mortgage Seconds Trading Secrets

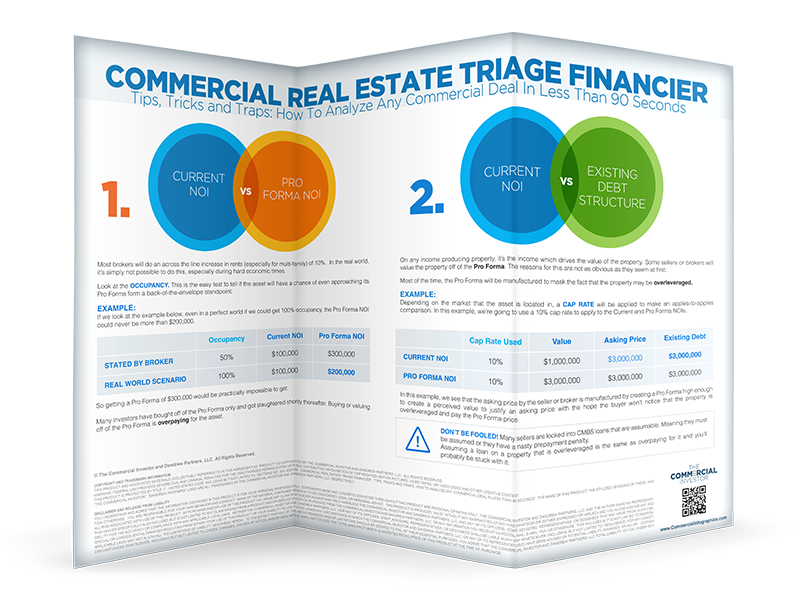

- How to determine Cap Rate and NoI

- Income and Equity Kickers… for FASTER wealth creation

- Commercial Terms Selling

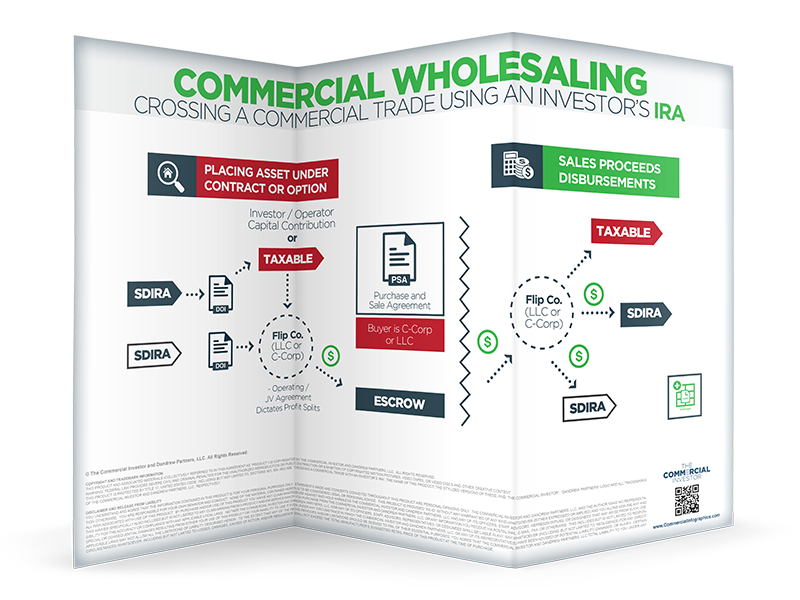

- Crossing a Commercial Asset Trade “Wholesaling”)

- How to finance the purchase of debt from a lender (“Collateral Assignments”)

- How to use a fee agreement to protect your incentives

- Understanding Term Sheets

- Create a credible business plan

- Understanding Equity, Credit, and Basis when Buying or Trading

- Note Hypothecation

- Land Leases

- A Note/B Note Structures

- First Trust Deed, Mezzanine Structures

- Multifamily

- Conversions

- Mini Storage Units

- New Construction

- RV Parks

- Retail

- Warehouses

- Office Buildings

- Anchored stores

- Industrial Parks

- Strip Malls

- “Special Situations”

- Non-Anchored Stores

- Mobile Home Parks

- Buildings for professionals

Membership to The Investors Syndicate

Download immediately The Investors Syndicate – Annual

- Commercial Real Estate Expert Trainings

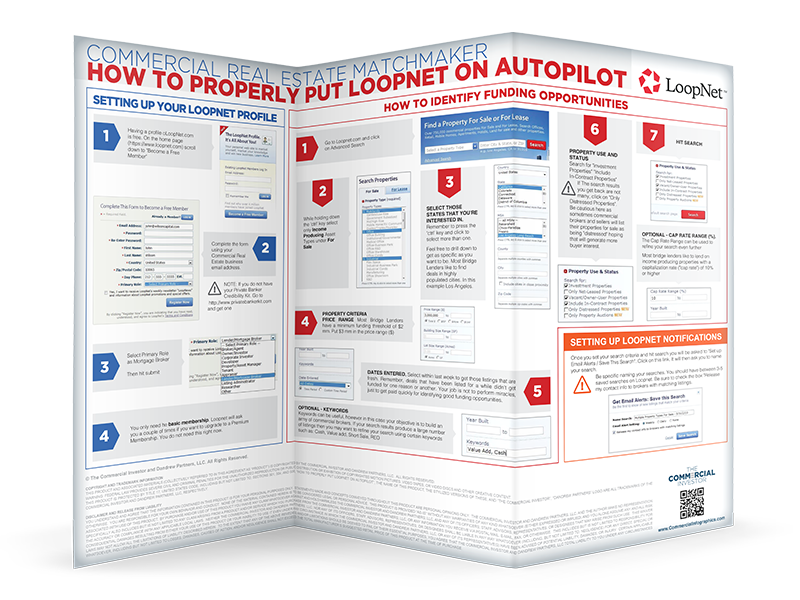

- Checklists, Templates, & Blueprints

- Live Recorded “Deal Maker” Interviews

- “The Deal Clinic”Real deal case studies and monthly commercial deal reviews

- The Commercial Deal Structure Secrets Book

- The Investors Syndicate Private Forum

- The Weekly JG Mellon Institutional Investor Insider newsletter

- PLUS: Every month, new trainings, strategies, templates, live calls, real deals, and blueprints are added

IMPORTANT: This is it. “The Investors Syndicate – Annual” It is totally Downloadable And Available In your account

(In the event of a broken or lost link, we will renew your connection shortly.

We appreciate your patience.