What You’ll Uncover in Wyckoff Analytics Wyckoff Trading Course (WTC) Spring 2019

Wyckoff Analytics – Wyckoff Trading Course (WTC) Spring 2019

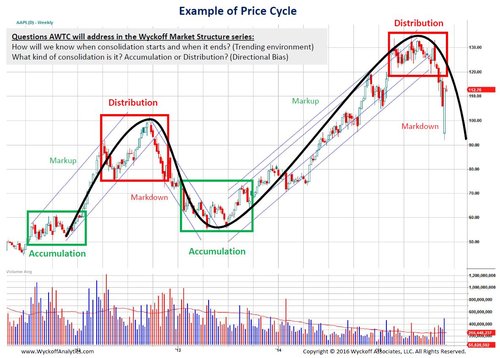

Description: Within the first 4 periods of the WTC, you’ll discover ways to to learn market construction by making use of Wyckoff’s cardinal insights concerning the interaction of value, quantity and time. Understanding market construction lets you anticipate coming value motion. You’ll study to establish and analyze accumulation, distribution, re-accumulation and re-distribution – the important thing buying and selling ranges that energy tendencies. Additionally, you will study Wyckoff Technique commerce set-ups primarily based on market construction, the way to enter a brand new or an current pattern, and the way to acknowledge prematurely when a pattern is more likely to finish.

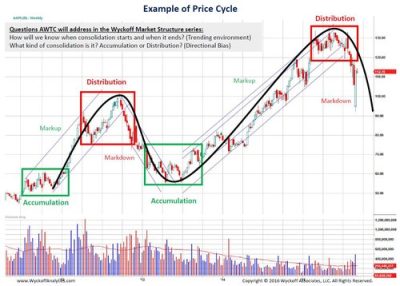

TWTR – WTC value cycle.jpg

The Worth Cycle: Accumulation, Mark-Up, Distribution and Mark-Down

Change of Character in a longtime pattern: figuring out a change from a trending to a non-trending atmosphere

Change of Character in a buying and selling vary: figuring out value and quantity motion signaling the initiation or continuation of a pattern

Trading ranges that generate huge tendencies: accumulation and distribution

A key idea in Wyckoff Technique evaluation of buying and selling ranges: Phases

Part anatomy: Wyckoff Technique occasions (e.g., climaxes, checks, springs, upthrusts, indicators of power)

Figuring out phases in accumulation and distribution

Traits of re-accumulation and re-distribution buying and selling ranges

Distinguishing re-accumulation from distribution and re-distribution from accumulation

Three Wyckoff Technique guidelines for trades primarily based on market construction

Delineating Shopping for and Promoting Zones utilizing the Wyckoff Technique, together with entry and exit methods

Workout routines and homework assignments

Mini-course Length: 4 on-line periods

Dates: Monday afternoons; January 7, 14, 21 and 28

Time: 3:00-5:30 p.m. (Pacific Time)

Price: $998 for the complete January-April cycle (15 periods); WTC alumni price: $700 just for the entire course!

To view a full free session of the Wyckoff Trading Course earlier than you enroll,please (recording made on January 7, 2019).

“Studying Wyckoff under Roman is one of the best decisions that I have made in my life. While progressing through the Wyckoff Trading Course, I earned 15x the money that I paid for tuition.” (PL – WTC graduate)

WTC Half II (Spring 2019) – SUPPLY AND DEMAND

Description: Right here Mr. Bogomazov will focus intimately on figuring out provide and demand on any chart. The Wyckoff Technique relies on the belief that every one freely traded markets are ruled by provide and demand. In as we speak’s markets, as in Wyckoff’s time, massive skilled pursuits dominate provide and demand. Being able to precisely learn provide and demand on a chart will mean you can make higher choices about timing your entries and exits and to affix the massive operators relatively than being caught on the fallacious aspect of a commerce.

-

Ideas in provide and demand – the forces that transfer all markets

-

Who’s the composite operator and the way do his actions out there have an effect on provide and demand?

-

Quantity and unfold evaluation

-

Variations of unfold and quantity in several market environments

-

Effort (quantity) versus outcomes (value motion) – affirmation and discordance each predict future value conduct

-

Quantity evaluation and schematics in buying and selling ranges

-

Quantity traits in several phases of accumulation and distribution

-

Wyckoff’s springboard: when value is poised to maneuver

-

Tradable quantity patterns

-

Workout routines and homework assignments

-

Mini-course Length: 4 on-line periods

Dates: Monday afternoons; February 4, 11, 18, and 25

Time: 3:00-5:30 p.m. (Pacific Time)

Prerequisite: WTC Half I (Wyckoff Structural Worth Evaluation) or consent of teacher

“Roman, without question, your instruction is exceptional and your patience endless. You have such a mastery of this material…[and] offer exceptional value both for the knowledge and time that is made available to students. There is no doubt that you walk in the noble footsteps of Wyckoff himself: developing and sharing knowledge without reserve.” (JC – WTC graduate and present WMD participant)

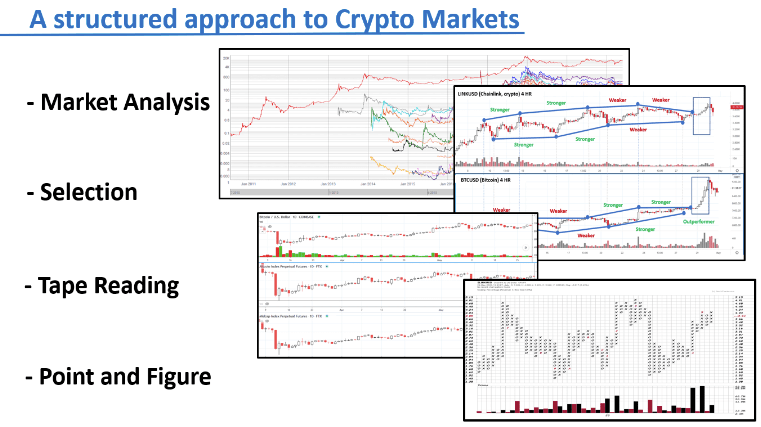

WTC Half III (Spring 2019) – RELATIVE AND COMPARATIVE STRENGTH

Description: Relative and comparative power are Wyckoff Technique ideas that may assist you choose the highest shares in one of the best sectors to commerce, notably at market turns. On this a part of the course, you’ll discover ways to apply these ideas to establish candidates for lengthy or quick trades, and the way they will also be used to enhance the timing of your entries and exits.

-

Relative and comparative power evaluation: how to decide on one of the best autos to commerce

-

Use of comparative power for inventory choice within the Wyckoff Technique

-

Bettering the Wyckoff Technique’s comparative power evaluation in buying and selling ranges

-

Variations between relative and comparative efficiency

-

Utilizing adjustments in relative power or weak point to identify sectors and shares to commerce

-

Creating choice filters utilizing relative and comparative power to establish excessive-chance trades

-

Workout routines and homework assignments

-

Mini-course Length: 4 on-line periods

Dates: Monday afternoons; March 4, 11, 18, and 25

Time: 3:00-5:30 p.m. (Pacific Time)

Prerequisite: WTC Elements I and II (Wyckoff Structural Worth Evaluation and Provide and Demand) or consent of teacher

“If you want to trade and trade well, the knowledge that you gain from the WTC is invaluable. You will really understand the price/volume action of the markets.”

(DF – WTC graduate)

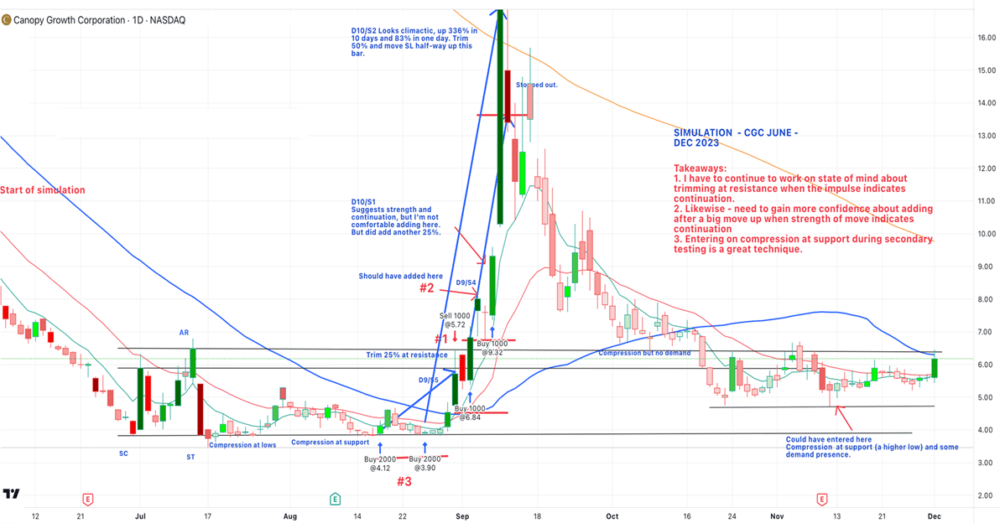

WTC Half IV (Spring 2019) – PUTTING IT ALL TOGETHER: DEVELOPING A WYCKOFF TRADING PLAN

Description: The earlier sections of the WTC incorporate foundational parts of the Wyckoff Technique and are designed to mean you can instantly apply standalone ideas to your personal buying and selling. For college kids who wish to combine these parts extra deeply, Mr. Bogomazov teaches the way to create a Wyckoff buying and selling plan within the remaining three WTC periods. As a result of the content material of this part depends so closely on supplies introduced beforehand, participation might be restricted to college students who’ve attended WTC Elements I, II and III.

-

Utilizing filters to enhance choice of shares or choices to commerce

-

Relative power filters

-

Structural filters

-

Provide and demand filters

-

Utilizing a number of filters to pinpoint one of the best trades and instances to open positions

-

Market Evaluation as a Filter – timing entries in sync with the market

-

Utilizing Wyckoff Technique ideas to create a buying and selling plan

-

Again-testing your buying and selling plan with a pre-formatted Excel template – key variables to trace

-

Trading techniques in your Wyckoff buying and selling plan: entries, place administration, and exits

-

Workout routines and homework assignments

-

Mini-course Length: 3 on-line periods

Dates: Monday afternoons; April 1, 8 and 15

Time: 3:00-5:30 p.m. (Pacific Time)

Prerequisite: WTC Elements I, II and III, or consent of teacher

Obtain instantly Wyckoff Analytics – Wyckoff Trading Course (WTC) Spring 2019 now

Here is What You may Get in Wyckoff Analytics – Wyckoff Trading Course (WTC) Spring 2019

IMPORTANT: This whole “Wyckoff Analytics – Wyckoff Trading Course (WTC) Spring 2019” is totally downloadable and out there in your account

(In case of a damaged hyperlink, we are going to renew your hyperlink shortly).

Your endurance is appreciated.